The alcoholic beverage market is undergoing a significant transformation as consumers' tastes and preferences evolve. Health consciousness, social dynamics, and a desire for new and diverse flavors are influencing the choices people make when it comes to alcoholic drinks. From traditional spirits and wines to emerging trends like low-alcohol options and craft beverages, understanding consumer behavior is key for brands and retailers looking to stay ahead. This blog delves into the factors driving these changes, exploring how different demographics and motivations are shaping the way we consume alcohol today. Whether it's a shift towards moderation or a preference for unique experiences, the landscape of alcoholic beverages is more diverse and dynamic than ever.

Cheers to Mindful Sipping

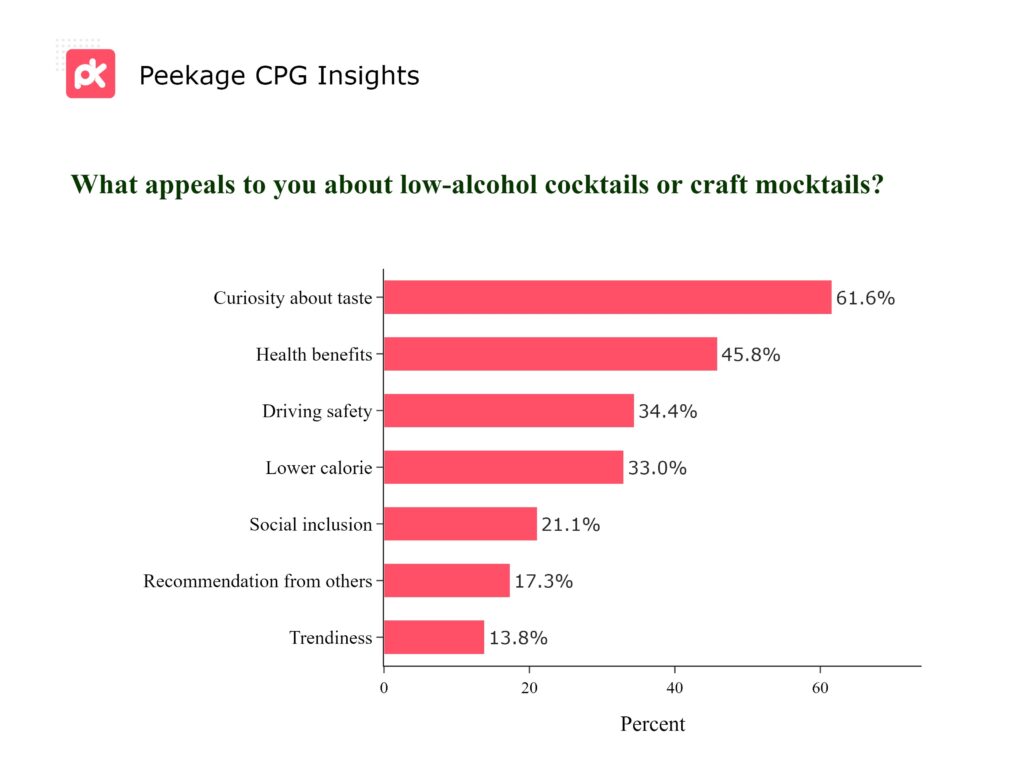

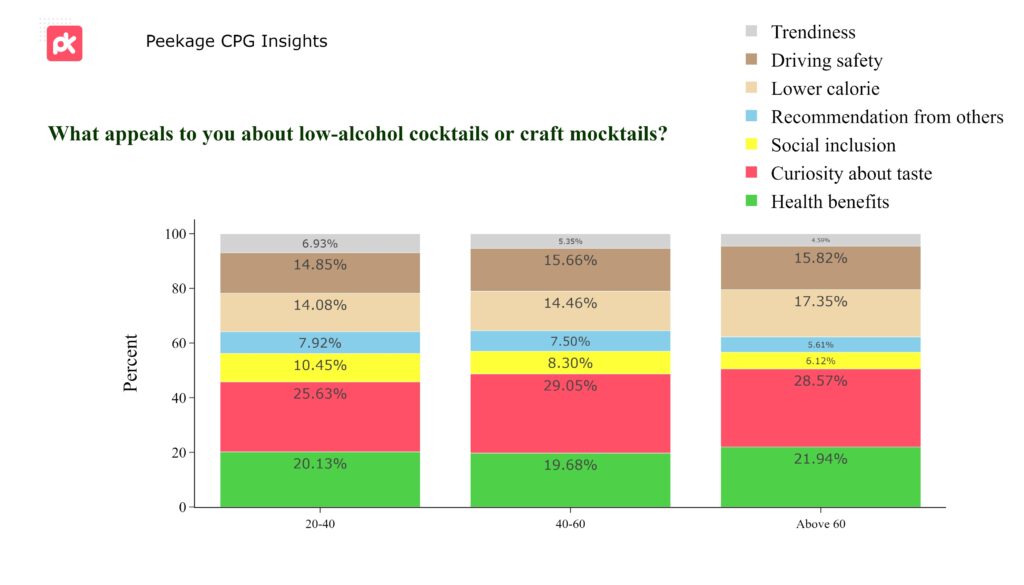

While mocktails obviously prompt curiosity for their taste, they also meet other consumer needs. A significant 45% of people choose mocktails for their health benefits, and 27% prefer them for their low-calorie content, reflecting an emerging trend towards healthier drinking options. Additionally, 21% of consumers opt for mocktails to feel included in social gatherings without consuming alcohol, an indication of their growing popularity as a versatile and inclusive beverage choice.

Takeaway: Highlighting the innovative flavors and health benefits of your low-alcohol and mocktail offerings is crucial. Emphasizing their low-calorie content is particularly significant for consumers who value enjoyable yet healthy drink options, especially when balancing social activities with health-conscious choices.

Sober Sipping

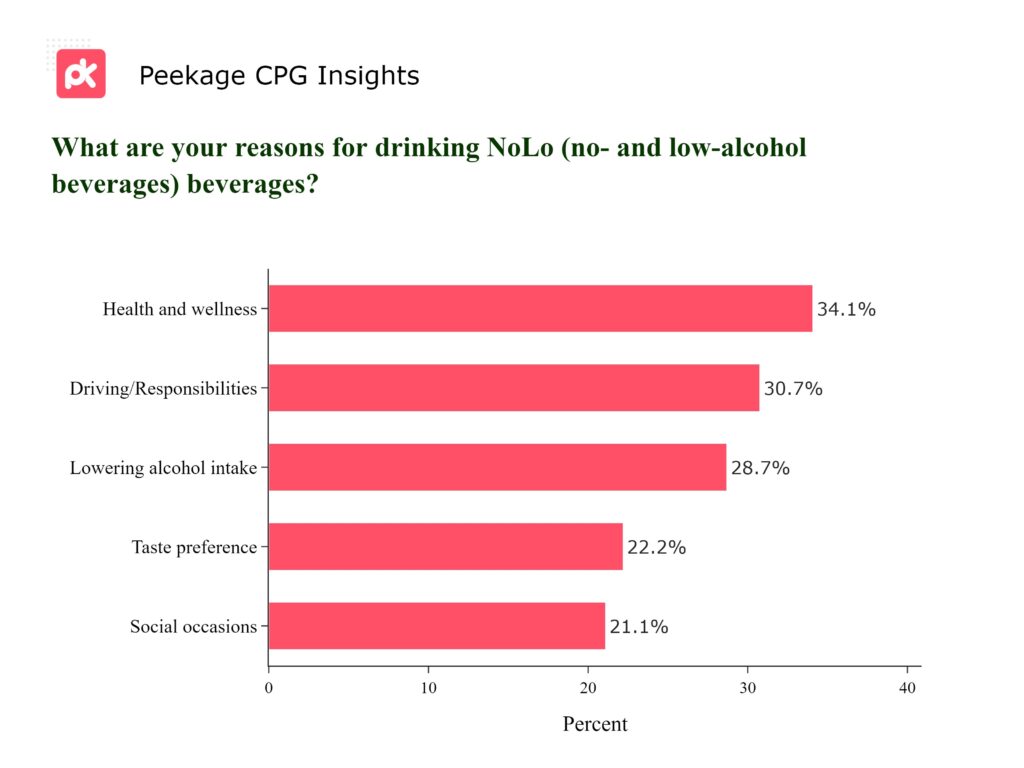

wellness top the list, influencing 34.1% of consumers. Driving and responsibilities come in close, with 30.7% prioritizing safety and obligation. Lowering alcohol intake is another significant factor for 28.7%, suggesting a shift towards more mindful drinking habits. Taste preference (22.2%) and social occasions (21.1%) also play crucial roles, indicating that flavor and social context are key considerations for many NoLo consumers.

Takeaway: As the shift towards NoLo beverages is primarily driven by health reasons and responsibilities, focus on innovating NoLo options that enhance health benefits. Additionally, given the strong desire for low-alcohol drinks, consider developing beverages that mimic the taste of alcohol. This approach can attract customers who are still fond of traditional alcoholic flavors but are looking to reduce their alcohol consumption.

Age-Wise Abstinence

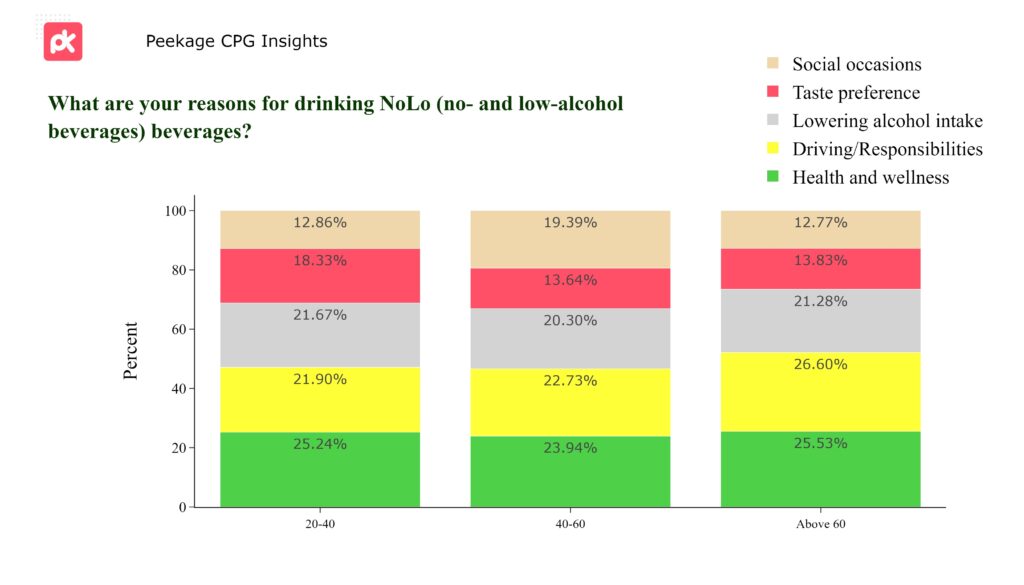

The reasons for drinking NoLo (no- and low-alcohol) beverages vary across age groups. The 20-40 age group shows a balanced spread, with health and wellness leading (25.2%) and driving and responsibilities significant (21.9%). For the 40-60 demographic, driving and responsibilities increased slightly (22.7%). For those above 60, driving and responsibilities (26.6%) and health and wellness (25.5%) remain the primary motivators.

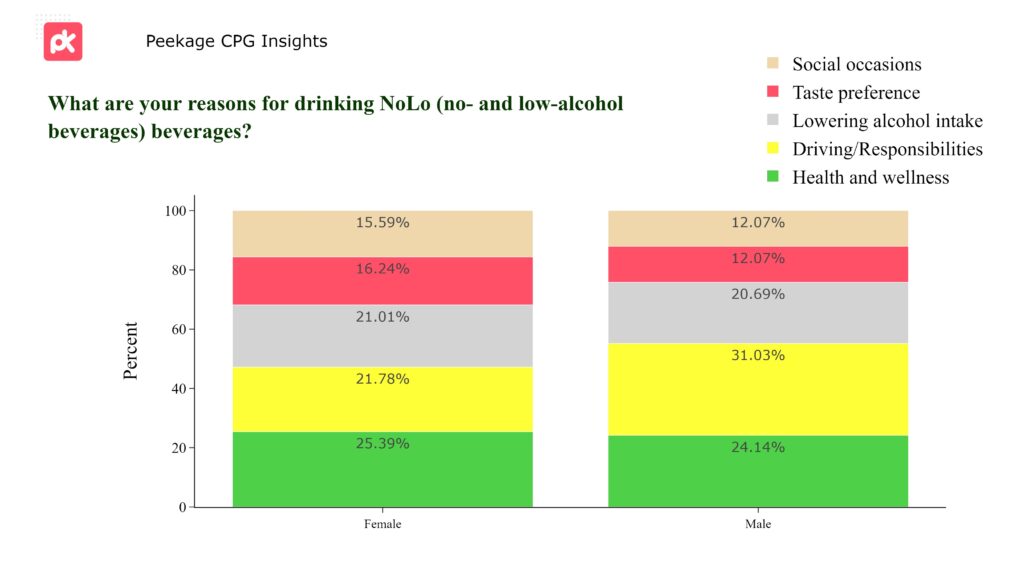

Gendered Glasses

The motivations behind choosing NoLo (no- and low-alcohol) beverages reveal interesting gender differences. Among women, health and wellness is the primary driver (25.4%), followed closely by driving and responsibilities (21.8%), and lowering alcohol intake (21%). Social occasions and taste preference also influence their choice, though to a lesser extent. For men, driving and responsibilities take the lead (31%), with health and wellness also playing a significant role (24.1%). Lowering alcohol intake, social occasions and taste preference are comparatively less influential factors for men.

Takeaway: NoLo beverage brands should consider these gender nuances in their marketing strategies. For male consumers, highlight the importance of responsibility, particularly in contexts like driving, along with the health aspects. Across both genders, enhancing the flavor profile, emphasizing the health benefits and the role of NoLo drinks in responsible lifestyle and positioning NoLo beverages as suitable for various social settings can broaden their appeal.

Exploring Low-Alcohol & Mocktail Trends

In the 20-40 age bracket, there's a strong interest in exploring new tastes (25.6%) and a focus on health benefits (20.13%), striking a good balance between trying new things and staying healthy. As people get older, they rely less on recommendations and fitting in socially, but they still lean toward discovering new flavors and being mindful of safety and calories.

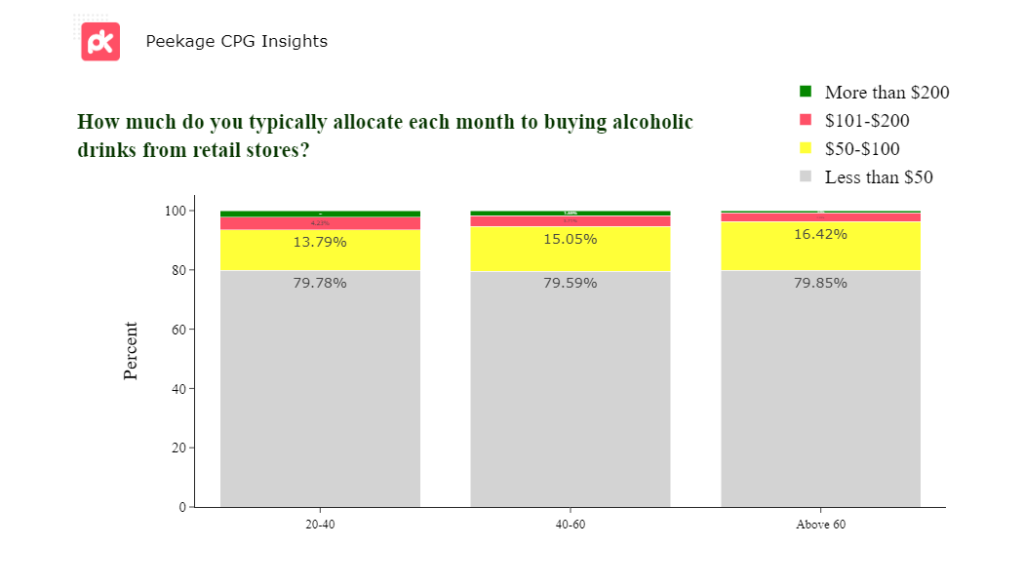

Spirited Spending

Age does not significantly influence the purchase of alcoholic beverages from retail stores. However, spending patterns reveal that a substantial 80% of customers spend less than $50 per month, with only a small fraction spending more than $200.

Takeaway: For alcohol retailers and brands, this data indicates a strategic focus on affordable, value-for-money options could effectively target the majority of consumers across all age groups. Implementing special promotions or discounts could attract the budget-conscious segment. Simultaneously, it's crucial to cater to the smaller, more affluent segment with premium product offerings.

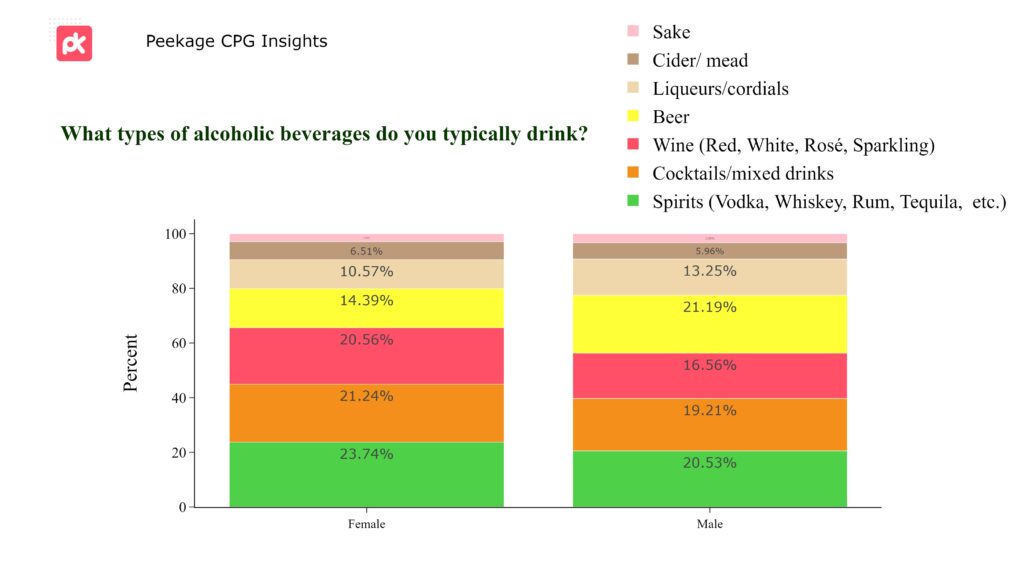

Gendered Favorites from the World of Alcohol

The divide reveals distinct preferences: women tend to favor spirits and wine, with cocktails also being popular, indicating a taste for variety and complexity. Men, on the other hand, prefer beer and spirits, showing a liking for traditional and robust flavors.

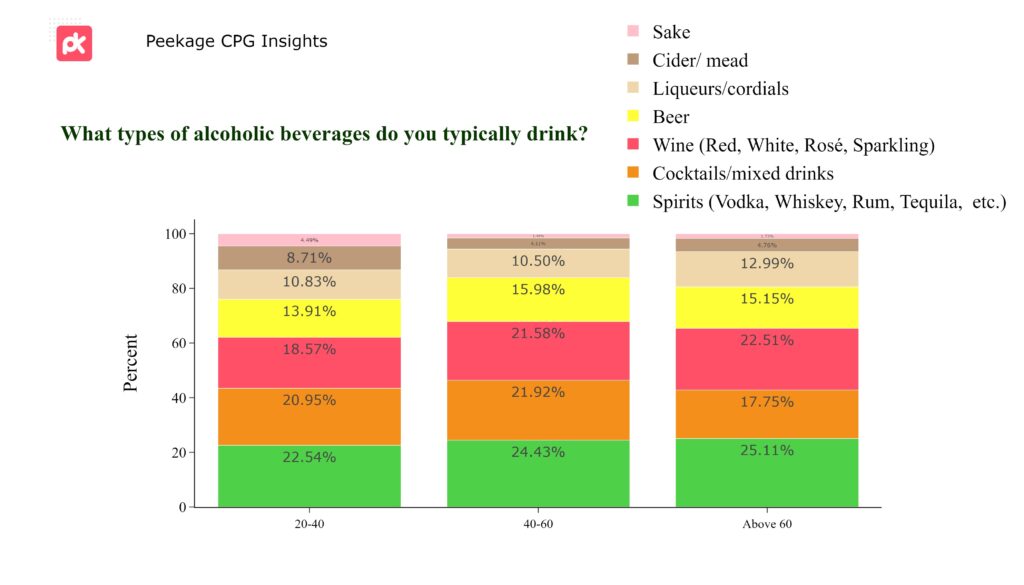

Marketing to Generational Tastes

New generations, Gen Z and millennials are more health-conscious compared to previous generations, resulting in an increased consumption of soft alcohols like cider and seltzer. As people age, regardless of their generation, there is a noticeable shift towards consuming more spirits and wine, and a decline in the consumption of sugary beverages like cocktails and mixed drinks, with only 17% of those aged above 60 consuming these options.

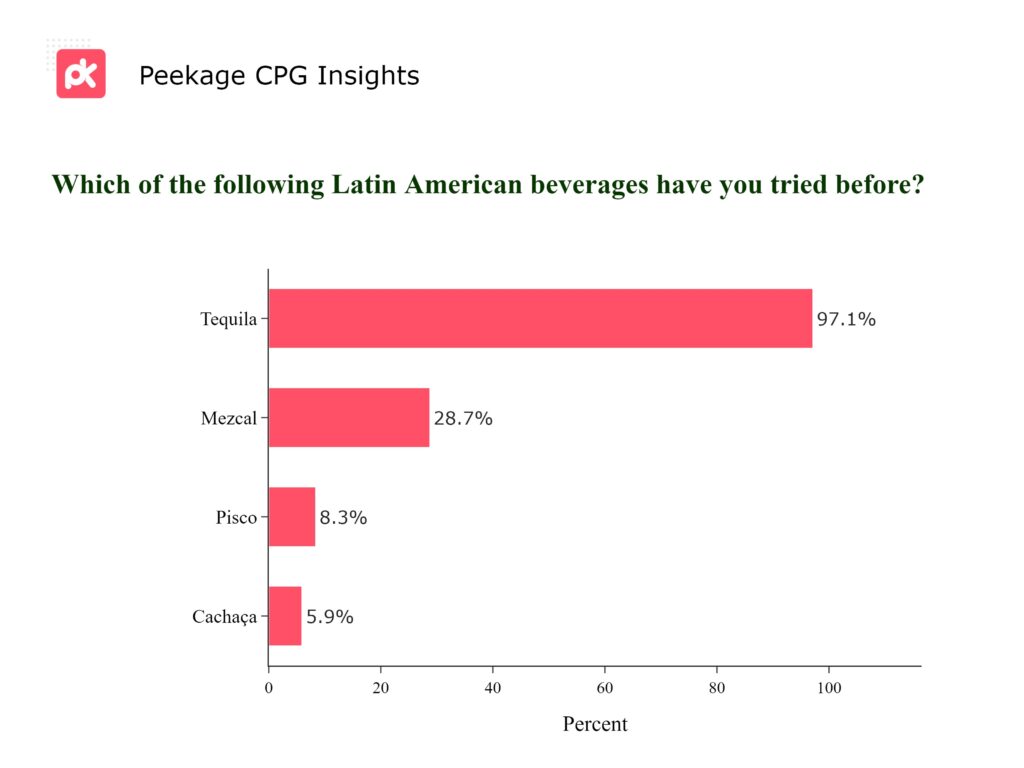

Spirits of Latin America

It's no surprise that Tequila leads as the most tried Latin American drink, dominating with 97% of customers. Mezcal is also gaining popularity, with nearly 29% of customers having given it a try.

Takeaway: While Tequila remains the obvious choice, there's a growing market opportunity for Mezcal that is projected to expand further. If you’re looking to diversify their offerings and tap into emerging trends, Mezcal presents a compelling option among Latin American drinks.

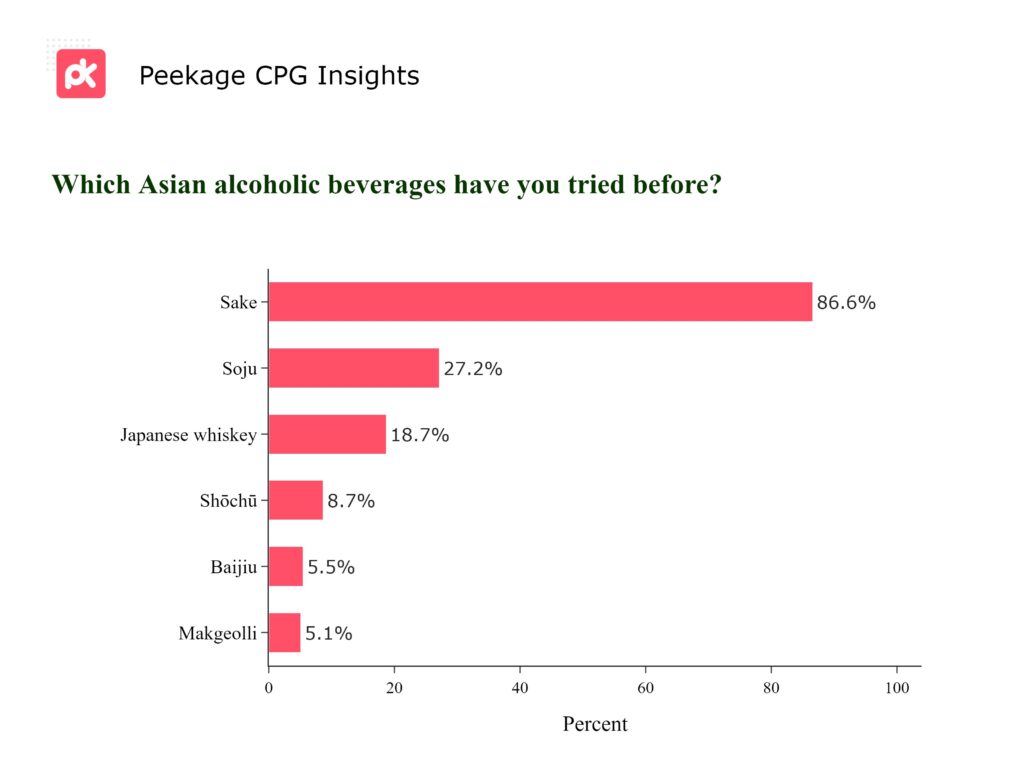

Sake Steals the Show

When it comes to the Asian drinking market, Sake leads the pack, with 86.6% of respondents having tried this traditional Japanese rice wine, highlighting its global appeal. Soju follows with 27.2%, reflecting the rising interest in Korean culture and cuisine. Japanese whiskey, known for its craftsmanship, has been sampled by 18.7%, indicating a growing market for premium spirits.

Takeaway: Brands should capitalize on Sake's popularity, exploring opportunities for expansion and innovation. Soju's social drinking culture can be leveraged to increase its global presence. For Japanese whiskey, focusing on its artisanal quality and heritage will attract fine spirit enthusiasts. Additionally, Shochu, Baijiu, and Makgeolli offer exciting prospects for brands willing to educate and engage consumers looking to diversify their alcohol choices.

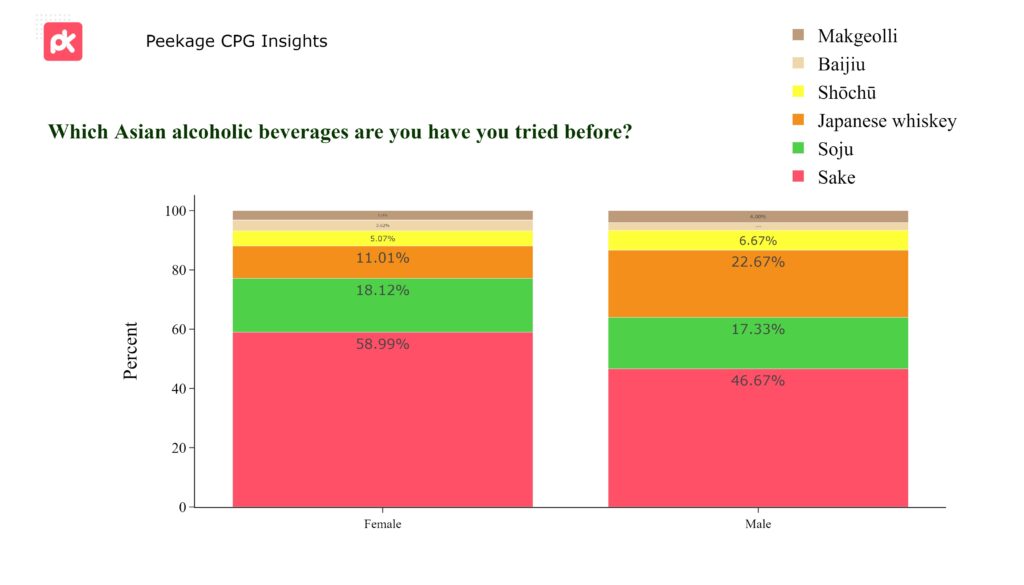

Exploring Asian Spirits: A Gender Perspective

Women show a strong preference for Sake (59%), followed by Soju (18.1%) and Japanese whiskey (11%). Baijiu, Makgeolli, and Shochu have niche followings among women. Men also favor Sake (46.7%) but show more interest in Japanese whiskey (22.7%). Soju is popular among men, while Baijiu, Makgeolli, and Shochu have modest attention.

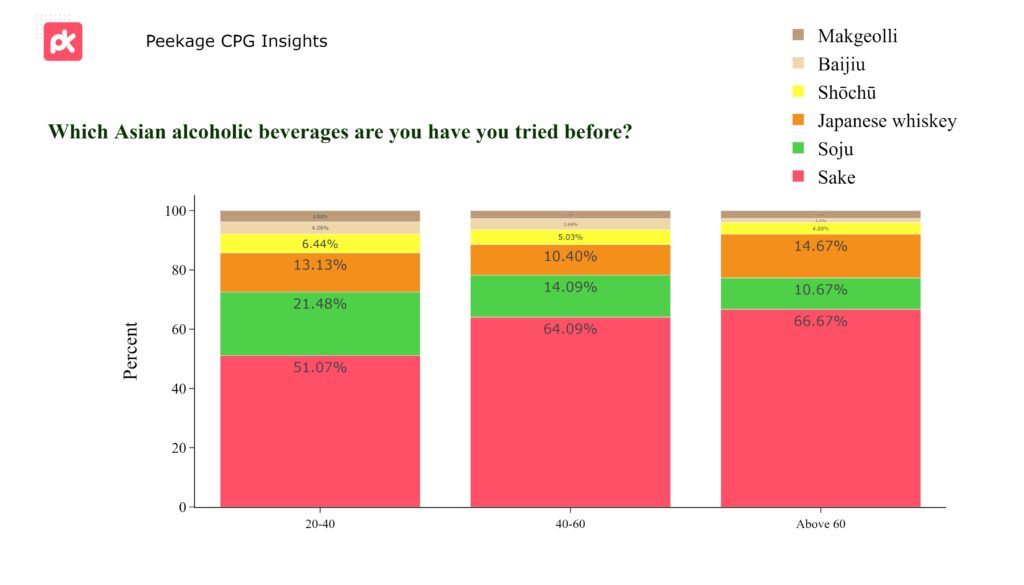

Asian Alcoholic Beverages Explored

The 20-40 age group demonstrates a strong preference for Sake (51.1%), indicating a matured palate, while Soju remains a popular choice. In the 40-60 age group, Sake's popularity increases significantly (64.1%), highlighting a deep appreciation for this traditional brew, with Soju and Japanese whiskey seeing less interest. For those above 60, Sake continues to dominate (66.7%), underscoring its enduring appeal across all age groups.

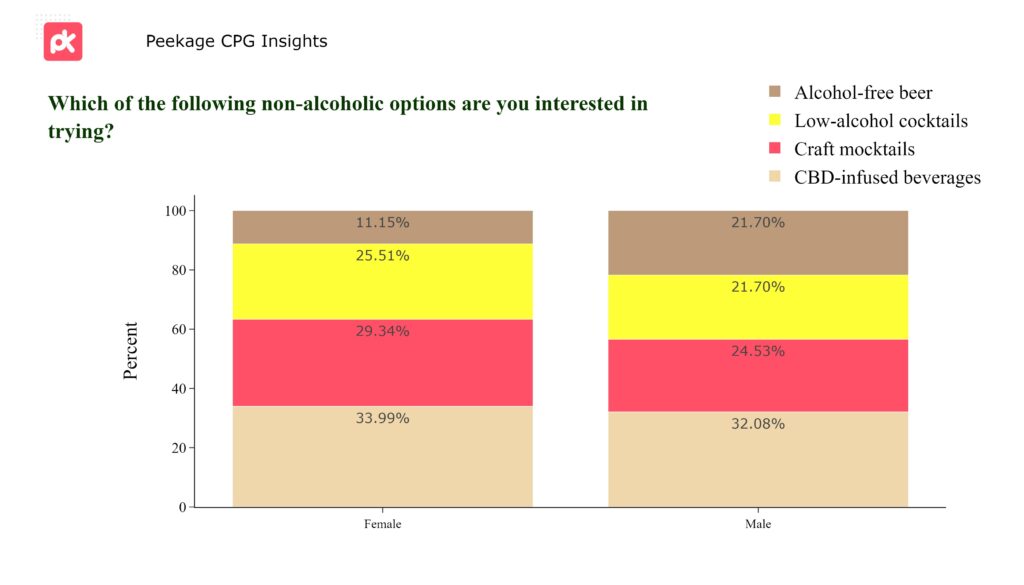

Non-Alcoholic Picks: Men and Women

Both men and women are really into CBD-infused beverages these days. Women seem to dig low-alcohol cocktails and craft mocktails, showing they're into more flavored non-alcoholic options. In contrast, men show more interest in alcohol-free beer, indicating a growing appreciation among both men and women for non-alcoholic choices with a distinct flavor profile.

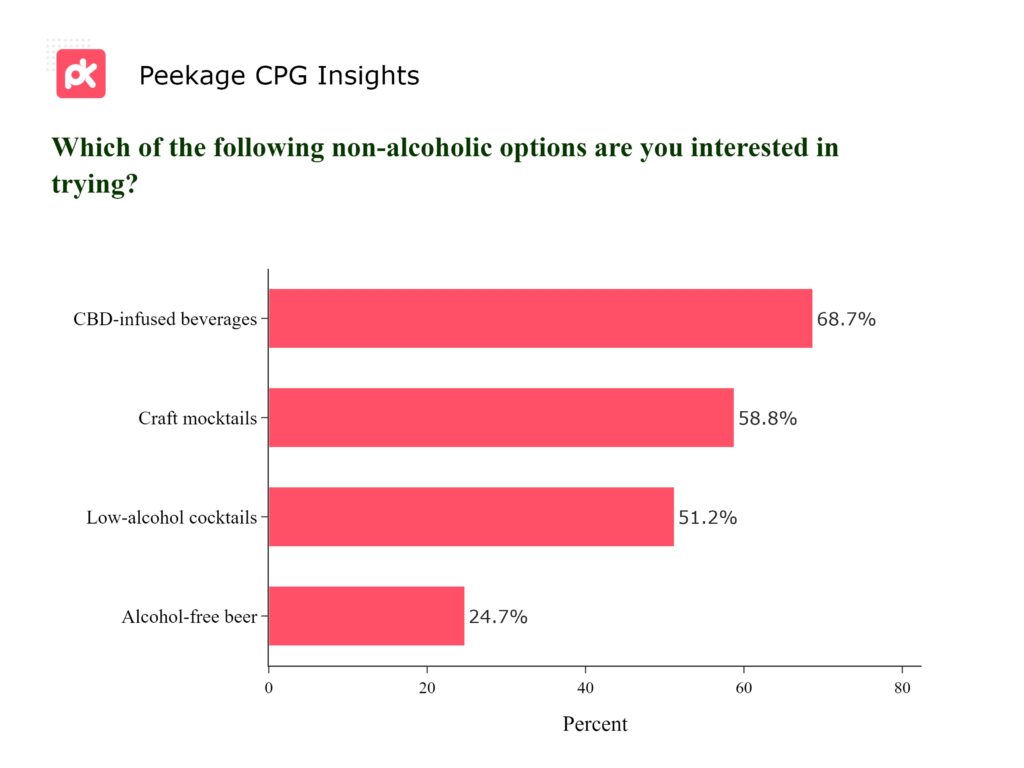

Sober Curiosity

CBD still piques curiosity, with nearly 70% of consumers interested in trying CBD-infused drinks. With cannabis legalization in North America, more customers are considering replacing alcoholic beverages with CBD options. Mocktails also show strong interest, with nearly 60% of consumers curious about them. However, low-alcohol beverages lag in preference, as people tend to either eliminate alcohol or consume it fully.

Takeaway: This data highlights a prime opportunity for brands and marketers to innovate. The high demand for CBD-infused beverages and craft mocktails indicates a market shift towards drinks that offer health benefits or artisanal flair. Investing in these areas, through new product development or creative marketing that emphasizes their unique qualities, can attract wellness-focused consumers. The lower interest in alcohol-free beer suggests a need for reinvention, perhaps by adding novel flavors or health-boosting ingredients to renew its appeal.

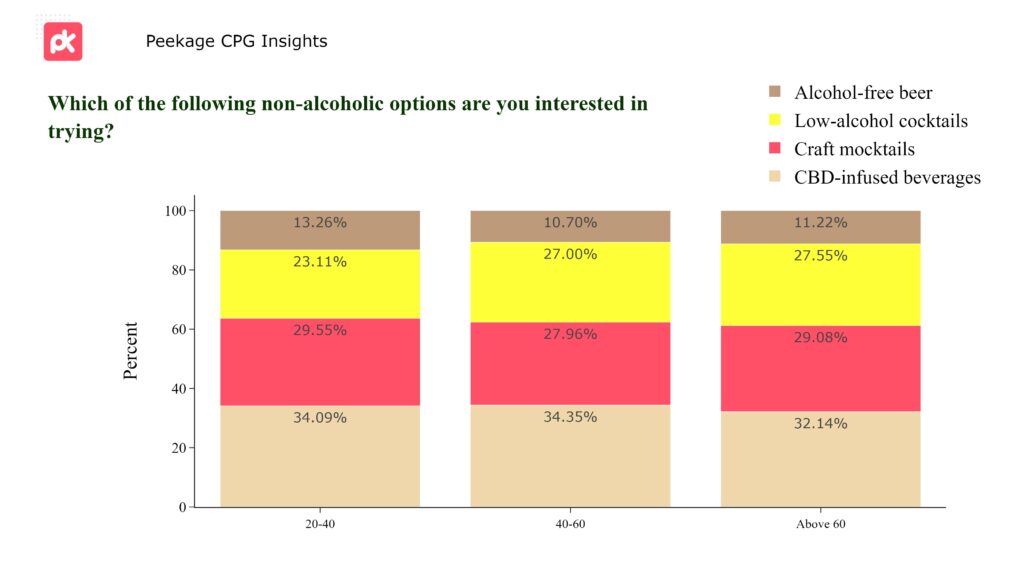

CBD-infused options Across Generations

CBD interest declines with age, alongside a decrease in non-alcoholic beer consumption. This shift underscores a growing preference for beverages offering health benefits and relaxation without alcohol's effects.

Takeaway: Targeting the 20-60 age group with varied flavors and formulations can position CBD beverages as a sophisticated alternative to traditional beer. For younger and older demographics, educational campaigns can dispel misconceptions about CBD, promoting its safety and advantages to expand market appeal.